The Digital Nomad Visa vs Autónomo In Spain: Which One Is Right for You?

Spain offers buzzing cities, a sunny climate, and an excellent quality of life. For many contractors, freelancing in Spain has become a major career goal.

And with the rise of the Spanish digital nomad visa, working remotely in Spain has never been more enticing.

In this article, we will:

- Explore the perks of Spain’s digital nomad visa.

- Compare it with the option to register as self-employed (known as becoming an autónomo in Spain).

With this guide, we’ll help you decide which visa works best for you, getting you one step closer to a Spanish freelance adventure!

What is the Spanish digital nomad visa?

In January 2023, Spain launched their digital nomad visa. It was introduced in line with the Spanish startup law, which aims to attract remote workers from outside the EU, boosting Spain’s appeal as a hub for international talent and enterprise.

Who is eligible for the digital nomad visa?

This is a Spanish work visa for non-EU freelancers who work remotely for foreign clients or a foreign company (i.e. entities outside of Spain).

To qualify, applicants must prove they have a minimum income of €2,400 (£2000) per month. If you relocate with a partner and/or children, you may be subject to a higher income threshold.

The perks of the digital nomad visa

- Low tax rates: consultants enjoy a reduced tax rate of 15% for up to 4 years with this visa. A great opportunity to boost self-employed earnings.

- Residence permit: when you’re approved for a digital nomad visa, you’re also given a residence permit. This allows you to legally live and work in Spain for up to 12 months initially, with the possibility of extensions.

- Ability to bring family members: this visa extends to spouses and children allowing freelancers to share the experience with loved ones.

The challenges of the digital nomad visa

- Restrictions on working with Spanish clients: the digital nomad visa is designed to support non-domestic remote work. This means the vast majority of your earnings (80% minimum) must come from clients and companies outside of Spain.

- Renewal requirements: a digital nomad visa is initially valid for 12 months. It can be renewed annually with a maximum extension up to 5 years. However, you need to show proof of continued remote work, required income levels, and compliance with tax obligations in Spain. Failing to meet the requirements can lead to your renewal being denied.

- Tax residency implications: if you stay in Spain for more than 183 days in a year, this generally establishes tax residency. This means digital nomads may be subject to Spanish tax regulations, despite the tax advantages of the visa. It’s crucial to consult a tax professional to fully understand and comply with tax for freelancers in Spain.

If you don’t tick all the boxes for the Spanish digital nomad visa, there is another option for self-employed professionals working remotely in Spain.

Let’s walk you through it:

What does it mean to register as an autónomo (freelancer) in Spain?

Becoming an ‘autónomo’ in Spain means you are legally registered as a freelancer, self-employed worker, or small business owner.

Who qualifies for autónomo status?

Anyone offering services in Spain (who isn’t a contractor) can become an autónomo. Unlike the digital nomad visa, autónomo status is open to both EU and non-EU residents. Though it’s worth noting, as a non-EU resident you will also need a self-employed work permit.

The perks of the autónomo status

- Freedom to work with Spanish clients: as an autónomo you have the freedom to work with both foreign and Spanish clients. This allows you to expand your freelance network, along with your earning potential.

- Full business autonomy: as the name suggests, being an autónomo means complete autonomy over your work schedule, your projects, and who you choose to work with – inside and outside of Spain.

The challenges of the autónomo status

- High social security fees: Spain’s social security contribution for autónomos has changed several times in the past few years. Even so, most self-employed workers in Spain pay higher contributions than employed workers. They also pay the highest rates in the EU. Your fees will depend on your income bracket.

- Complex tax obligations: as an autónomo you must pay personal income tax (Impuesto sobre la Renta de las Personas Físicas) and Value Added Tax (Impuesto sobre el Valor Añadido or IVA). Your exact rate of personal income tax depends on the region of Spain you live in and it varies from 19% to 47%.

- Admin responsibilities: autómonos are responsible for filing quarterly tax returns. An annual tax return is also due between April and June each year. On top of this, you must add a Value Added Tax (VAT) to your client invoices. You need to declare the amount of VAT that you have collected and paid each quarter, with the difference paid to the Agencia Tributaria.

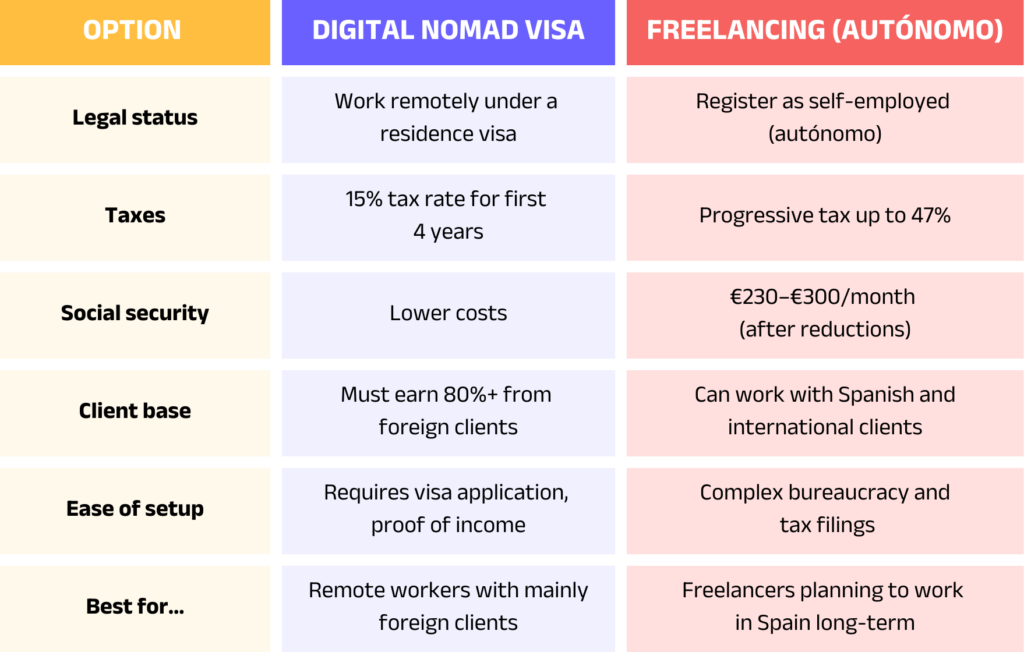

Comparison at a glance: digital nomad visa vs. autónomo in Spain

The premium alternative: how Hightekers simplifies freelancing in Spain

We understand the challenges faced by many freelancers keen to work remotely from Spain. From bureaucracy struggles to high social security costs, and a complex tax system.

The Hightekers solution removes all the hassle, which means our consultants enjoy the best of both worlds.

Our contractor management solution provides you with the security of a full-time contract while keeping the flexibility of freelancing. What’s more, there’s virtually no paperwork for you to get bogged down by.

Here’s how Hightekers simplifies remote work in Spain:

- We ensure your legal compliance – without the hassle of autónomo or digital nomad visa registration.

- You pay lower social security – compared to autómono. Plus we take the tax burden right off your desk.

- You can work with Spanish and international clients – freely.

- We handle payroll and invoicing on your behalf – say goodbye to quarterly tax filings.

- Access to employment benefits – such as health insurance and pension contributions.

Which option is right for you?

We created this guide to help consultants make an informed decision about the visa that best suits business goals and aspirations for working remotely in Spain.

Let’s recap the options:

- If you only work with foreign clients and want a simple visa, the digital nomad visa could be an option

- If you want full autonomy and plan to have Spanish clients, becoming an autónomo is the better choice – but be prepared for high costs and a hefty amount of paperwork.

- If you want a hassle-free way to freelance in Spain, Hightekers offers a smarter alternative that combines job security with freelance flexibility.

Breeze your relocation to Spain with Hightekers today!